Getting into your perfect domestic or hiking the property ladder are higher. Having the financial that goes with they? Far less fun.

In the big date we have a new financial we are all very focused on something paying it well. Quick.

Even with interest levels as low as he or she is at this time, mortgage brokers continue to be big investments, and additionally they could cost a great deal.

An effective $eight hundred,000 mortgage with a speed out of 3.00% p.a. gets monthly money away from $step one,686 and wind up costing you $207,110 inside desire costs over the 31-seasons lifetime of the loan (in addition to naturally paying down the initial $eight hundred,000) step one . Let’s telephone call so it all of our foot circumstances example’.

Now which is a big matter (and unfortuitously, you can’t succeed $0) but there is a great deal you can do to blow reduced, in order to pay your house loan ultimately.

Suggestion 1: Get a diminished interest

We understand the low the interest rate, the latest faster i spend. However, will it really generate anywhere near this much of a difference? This basically means, sure. Yes, it can.

This would reduce the focus will cost you because of the $38,136 along the 29-12 months longevity of the loan and relieve your minimum payments by $106 30 days. Nice.

In fact, predicated on investigation compiled by the latest Reserve Financial off Australian continent (RBA), this new weighted average rate of interest in for The most recent Manager-Occupied home loans is actually 3.02% p.a great. while The newest financing you to definitely times got an excellent weighted average rate away from dos.51% p.good. (a significant difference regarding 0.51%) dos .

Tip dos: In case the price falls, carry on your payments

Right down to the lower speed, the minimum payment amount has arrived down too. Playing with our analogy over you might keeps an extra $106 30 days on the pocket for many who made a decision to remain those individuals savings for your self.

Exactly what for many who leftover your payments at the same height because the prior to? Which is, imagine if you put one to additional $106 thirty day period towards your mortgage?

This will reduce the appeal costs of one’s financing from the $fifteen,530 along the longevity of the loan and also incisions an effective complete 3 years off the life of your loan. Sweet.

Suggestion step three: Separated your month-to-month repayment into fortnightly

But what carry out occurs for people who took your monthly payments, broke up they by 50 percent and you may paid down that every 14 days. Thus in place of using $step 1,686 thirty days your paid down $843 most of the 14 days.

The real difference is very large. Utilizing the feet case example, it could save $27,517 along the life of your loan during the notice can cost you and you may reduce the amount of the loan by over 36 months.

Why does it really works? This means that, you are making one to even https://elitecashadvance.com/installment-loans-tx/hudson/ more monthly fees annually. As the rather than and come up with 12x month-to-month repayments, you’re now and then make 26x fortnightly payments annually that’s equivalent so you’re able to 13x monthly money. Only speak to your lender if or not a charge enforce for making a lot more money.

Tip cuatro: Maximise your own counterbalance and you can redraw

An offset account are going to be attractive. An one hundred% offset membership reduces the notice you have to pay in your mortgage since notice try billed into the net balance your debt, perhaps not the whole mortgage equilibrium (web balance = financial balance due counterbalance account balance).

What if you’d $10,100000 reserved since your emergency loans, escape fund otherwise spend lavishly account and it is resting within the a purchase account getting zero notice.

If you had that money sitting when you look at the an offset membership linked to your residence mortgage alternatively, this will reduce the appeal can cost you on ft situation example by the $14,162 across the longevity of your loan and then have cuts you to definitely full season off of the life of your loan.

Idea 5: Stay away from other loans

While you’re concerned about paying your home loan, there might be minutes what your location is inclined to remove most other type of finance for different explanations such as that loan having an excellent holiday, vehicle or credit debt.

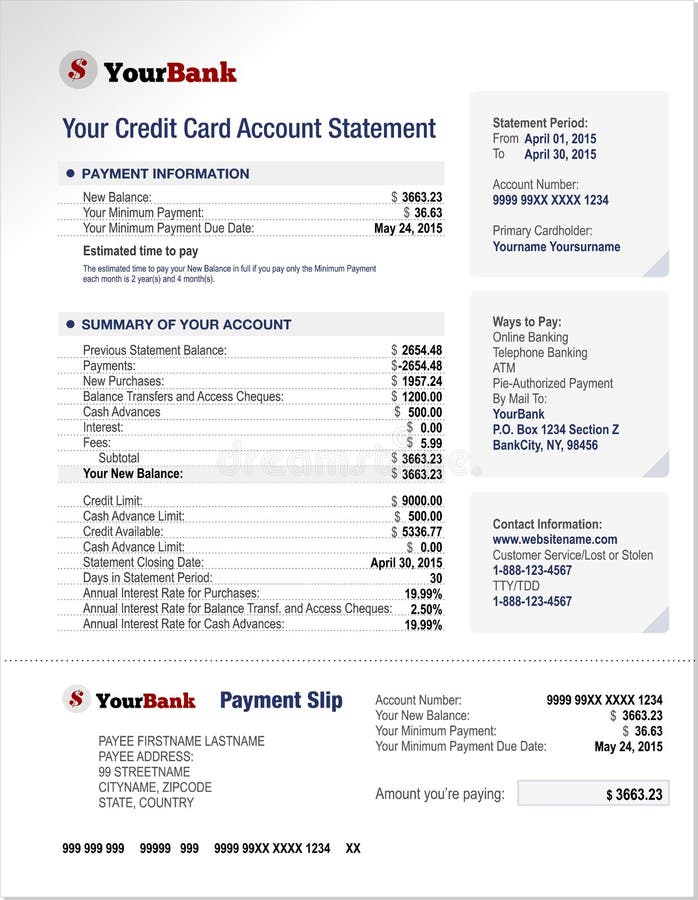

Appeal into a beneficial $5,100 loan will cost you $step 1,000 a-year in the 20% p.a. attract (such as for example a premier focus mastercard), $five hundred annually from the ten% p.an excellent. attention (including a low rates credit or unsecured personal bank loan) or $150 at step 3% p.an excellent. attract (just like your mortgage).

Now a personal loan could well be the best way to make sure you have to pay off your debt quicker because financing words is actually normally smaller. But if you can pay regarding $150 within the focus annually in lieu of $five-hundred, its worthwhile considering if a unique (and higher rate) loan is truly the most suitable choice for you.

Tip six: Do not get caught out-by costs

But whenever you are you may have the eye to the fundamental award, do not get caught out by fees. On average an Australian house that have a home loan, mastercard and you may checking account pays more $600 within the financial costs each year. YUCK!

As well as for folks who used that money to settle your loan instead monthly, you can cut a supplementary $9,800 from inside the interest in addition $18k across the 30 seasons longevity of the loan.

Idea seven: Most of the dollars counts

At Finspo, the audience is very worried about helping reduce the price of your home financing beforehand to reduce towards the some thing for the lives you really particularly.

Actually getting an extra $step 1 1 day to your financial ($31 thirty day period) can save almost $6,100 when you look at the attention can cost you over the life of your loan and slashed annually out of your home loan than the feet situation analogy significantly more than.

So if you possess a subscription you don’t have otherwise a health club registration you don’t explore, that money might possibly be assisting you pay off your house financing fundamentally. Just consult your financial if a fee enforce to make additional money.

So there they are, our very own best eight ideas to make it easier to repay your residence loan shorter. So if you’re now thought it is time to work, we have been prepared to help.

Exactly what you need to know: This information is standard merely and that is maybe not designed to become any testimonial otherwise tip on one types of borrowing from the bank product. It does not account fully for your financial situation, criteria, and you may expectations. Please contemplate if or not this information is best for you before generally making any decisions and you can find top-notch taxation or economic advice.

Instances in this article are derived from a $eight hundred,100000 prominent and you will attract financing that have fees regularity and you may label specified and you will assumes one to interest rates will still be undamaged on longevity of the loan. The brand new instances dont account for charges and you can charge that may use besides a great $600 app percentage.