Renovations can be quite expensive. They’re also one of the best assets you are able to – a, thoughtful home improvements make a bona fide difference to the high quality off life, and in some cases, might put enough really worth to your house to cover by themselves for many who afterwards plan to promote.

One method to financing home improvements is to borrow more income on the mortgage to cover home improvements. Its a relatively complicated answer to borrow even though, thus in this article, we shall describe just what actions are concerned and exactly how you might choose whether it’s a good idea to you personally.

If you’re considering an inferior project (?1,500-a dozen,000) consequently they are debating if or not you ought to obtain most on the financial or rating an unsecured loan, you might have a look at the loan calculator or make a loan application within koyoloans. Representative Annual percentage rate 27%.

And in case we should read more about how to borrow currency to own home home improvements having a consumer loan, you’ll be able to see our very own full help guide to the way to get a loan for home improvements.

Could you acquire more money on your home loan having renovations?

Sure, undoubtedly – borrowing from the bank even more in your home loan try a pretty well-known way to funds significant renovations, such renovating element of your home, including a loft sales otherwise putting in an alternate home.

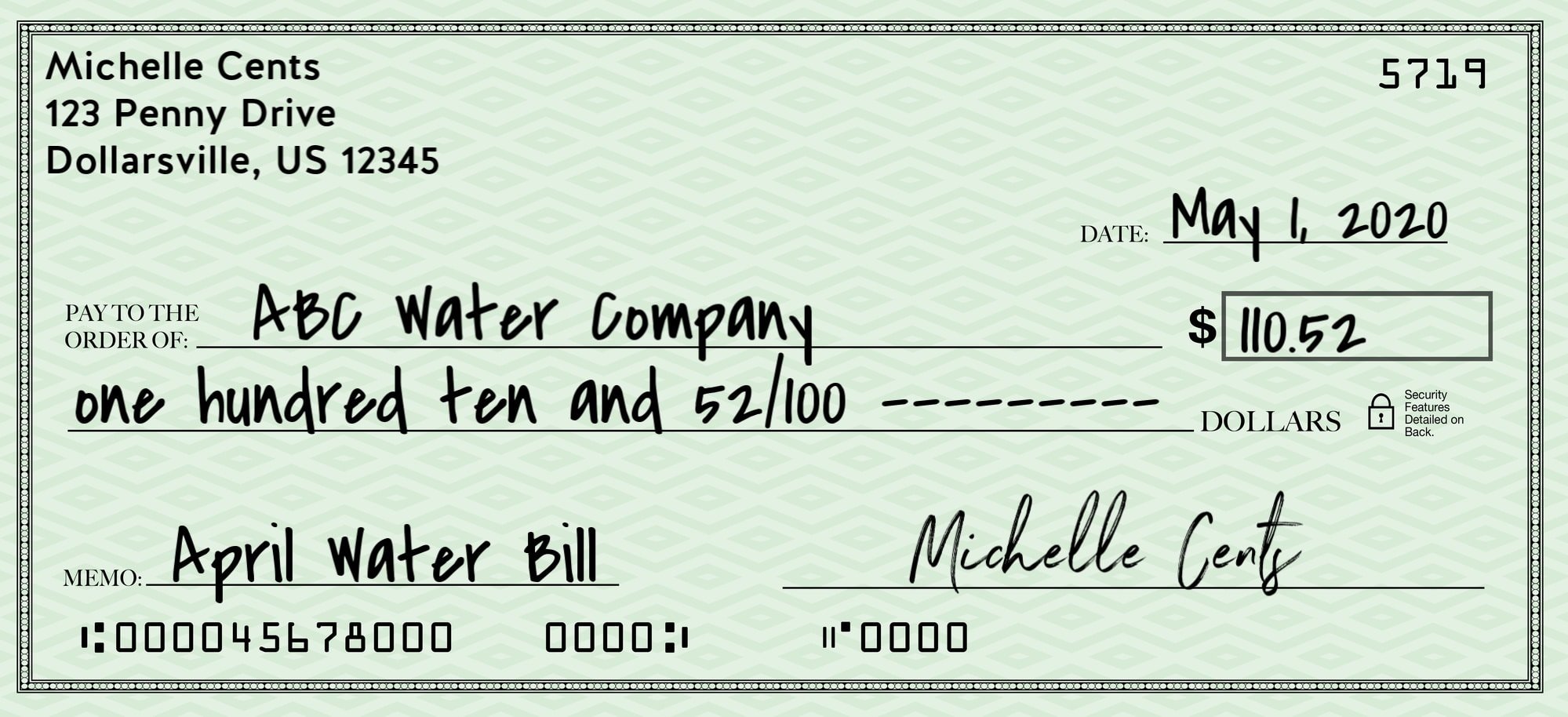

For people who remortgage and increase their borrowing in order to ?75,100, possible pay-off the present home loan nevertheless provides ?twenty five,one hundred thousand so you’re able to free

While it tunes effortless once you list it out this way, there are some challenge when you are given which in practice. We shall safeguards this type of payday loan Parker in detail after on the piece, but in no time:

If increasing the sized their mortgage places you in an excellent high LTV group (regarding one later on!), could result in purchasing increased interest rate on entire matter

three ways to borrow on the financial getting renovations

Before we become towards the real outline off remortgaging to cover home improvements, we are going to bring a fast breakdown of every home loan-connected choices that are likely to be on the market.

Remortgage to fund renovations

Here’s what we secure above – your change your established home loan which have a more impressive one to. Right after paying off the first mortgage, you employ the excess cash to cover your property improvements.

We’ll shelter they in full afterwards, but if you want so much more outline, you could potentially take a look at our complete post: remortgaging to possess renovations.

Then get better

A much deeper advance was a way to increase your borrowing from the bank out of your current home loan company. Constantly, the excess money you obtain is repayable on a separate desire price.

Not all the loan providers give then enhances, in case they do, it can be a lot more simple than remortgaging and may even save cash on charges. You’ll need to consult with your established bank to ascertain when it is something that they bring – usually you will need a loan-to-worth (LTV) ratio of 85% or all the way down.

The top advantage over remortgaging is that you won’t need to wait until your own mortgage term stops (elizabeth.grams. till the avoid of repaired months, when you have a predetermined-speed equipment).

A second charges home loan is a little more difficult – in this case, you will be in reality taking out another home loan, more often than not with a new bank, which means that you’ll have a couple of mortgages to repay.

This new 2nd charges identifies security: their brand-new bank are certain to get an initial fees in your domestic, and thus if you’re unable to pay-off, it can take your house and sell it making good recuperation. Your second lender perform a similar it is 2nd during the line, very try bringing far more exposure.