Dinesh Thakur are a thirty-yr old They market staff. He could be thinking of buying a house when you look at the 2021. 60 lakh. They are, yet not, not as obvious concerning app processes and you will what documents he should keep ready. Here’s what the guy should become aware of.

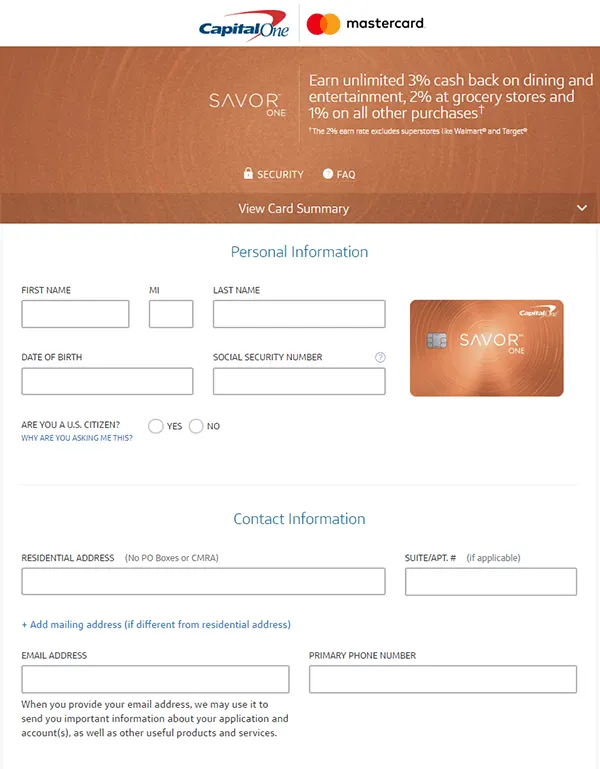

step 1. Fill up our home application for the loan Function: All create-become borrower, such as Dinesh, must fill-up a home loan form. This can encompass information such as label, address, money facts and evidence, employment facts, education facts, and you will contact number. Dinesh may also have to help you present proofs for all the above together with paycheck glides-to your most recent 90 days, a career facts, lender comments into most recent half a year as well as the newest Form sixteen, given that they are an excellent salaried employee. Self-functioning borrowers will have to provide the complete set of ITR yields the past 24 months along with other money files.

dos. Spend the money for Running Fee: After Dinesh submits their records he has to invest the initial control payment as determined by the financial institution, that is low-refundable. This might be billed on initial performs the bank does so you’re able to make sure debtor info in order to read the new property’s value and possession label. The remaining control fee try removed after at the time regarding disbursement. However, Dinesh’s financing may not be approved because he’s repaid these types of charge. Brand new fees start around lender so you can bank. They ount or a percentage of your loan amount. Axis Bank, instance, fees a charge as much as step one% of the loan amount (of at least Rs. 10,000+ relevant taxation).

3. Financial Discussion: The financial institution usually takes a decision as per lender credit coverage towards the whether to accept otherwise deny the borrowed funds app inside 5 business days. The bank may call Dinesh to own good telephonic talk. This is basically the instance for most salaried professionals. In case of mind-operating borrowers, the newest bank’s user could possibly get look at the customer’s place of work having personal discussion also to discover regarding their team. This helps the financing underwriter to upraise financing when you look at the good better way.

The guy need home financing away from Rs

4. File Verification: Because the bank completes the private discussion with Dinesh, it does start calculating their qualifications. This might encompass a lender formal going to their latest quarters and you can/otherwise getting in touch with their businesses. The financial institution usually consider Dinesh’s credit history which have a bureau such CIBIL.

six. Approve Page: The lending company will easy cash loans Vineland be sending Dinesh financing approve letter if the his financing is approved. Which letter commonly have Dinesh’s eligible loan amount, interest rate and type (repaired otherwise changeable) relevant, financing tenure that have conditions & status. When the Dinesh welcomes they, he’s to help you sign they and you may post a duplicate towards the lender.

eight. Possessions Confirmation: Since the loan has been approved and you will acknowledged, the lending company will make sure the house or property. It can do a legal check on the house or property to be sure the fresh new label is clear and there’s zero disagreement otherwise dispute about your same. It’s going to carry out a technical valuation into the property. When your house is not as much as structure, it will look at the phase, advances and you can top-notch build as well. Should your property is a selling property, the lending company often read the decades, quality and fix levels of the structure. It will also verify that the house has already been mortgaged. Dinesh will have to complete all the property paperwork, in addition to brand new duplicates of your title deed, on financial. These types of documentation are mortgaged into bank up to Dinesh repays the fresh new loan completely.

8. Mortgage Disbursal: Because the possessions confirmation is done, the client has to provide the documents depending on legal and you may tech reports. After that mortgage agreement try finalized assuming all files is in order, the borrowed funds gets disbursed plus the cheque is passed out to the client. This new cheque may be made in rather have of your own creator, if you find yourself purchasing the assets of a creator. Post-disbursement, the bank will send the consumer the latest invited system, in addition to the installment agenda. The brand new EMI payment is accomplished either using Reputation Guidelines, in the event your membership at which payment is generated try out-of an equivalent lender, otherwise through NACH mandate – should your account of which percentage is made is with other financial. (NACH or Nationalised Automatic Cleaning House Commission Solution is the fresh centralised program one to encourages this new seamless purchases anywhere between finance companies).

Already, home loan rates reaches historic lows, and you may individuals looking to buy property is to capitalise into the chance. Axis Lender has the benefit of a selection of home loan issues ideal for the needs of all the their users.

Recognition Techniques: This is the procedure (according to Lender Borrowing Coverage) which can decide if the bank usually agree Dinesh’s application for the loan

Click to learn more about Axis Financial Lenders. You can examine their qualifications by pressing here towards Axis Bank Mortgage Qualifications Calculator.

Disclaimer: The cause, a good Mumbai-mainly based article marketing, and you will curation corporation possess created this information. Axis Bank does not dictate the fresh views of journalist when you look at the in whatever way. Axis Bank while the Supply will not be responsible for people direct/indirect loss otherwise accountability incurred of the audience when deciding to take any economic choices according to research by the material and you can information. Delight speak to your economic advisor prior to making any economic choice.