That is Entitled to good USDA Financing?

Lower income individuals is actually a button category the fresh USDA system are geared towards. Retirees could be qualified, dependent on the earnings reputation, but employees must be for the earnings metrics regarding the application or they don’t be considered.

Which are the Requirements?

Your house getting bought must be located into the a USDA appointed rural urban area, and you will USDA mortgage officers is show eligibility of a particular location. Higher belongings are not allowed https://simplycashadvance.net/loans/student-loans/. The fresh new life style assets will be 1,800 sq legs or smaller with market worth less than the local average. Next, money of the debtor dont meet or exceed the lower money restrict into the town, each the USDA metrics (it’s usually below 115 % of one’s median income to possess the goal urban area).

Which are the Charges?

The fresh USDA system enjoys a couple charge, an excellent USDA mortgage premium of just one per cent of the mortgage lent and you may 0.thirty-five per cent annual fee. Essentially, one can possibly anticipate paying $1,one hundred thousand for each $100,100 borrowed at the start, and then an effective $350 percentage a year. * Each other would be integrated into the borrowed funds amortization rather than being energized instantly. Such fees was indeed dropped regarding higher profile for the 2016.

Pros and cons of USDA Finance

Some great benefits of the application are no down payment becoming required regarding get and you will completely money of the home, secured because of the government, a switch guarantee to own suppliers.

Simply because one is perhaps not a seasoned or trying to find way of living within the a smaller rural household does not always mean that he or she may be out of chance. There are many software available to advice about to order a house. New Government Homes Authority program is a big raise of these perhaps not eligible or looking for the above mentioned apps.

The FHA program is not a zero down-percentage solution. Rather than another applications more than, you will find an advance payment function on it, but it is much lower than just typical markets standards. Additional large feature would be the fact FHA fund lack due to the fact of a lot fees otherwise the charge tend to be smaller compared to the common industry revenue processes, again large offers.

Who is Qualified to receive FHA Loan?

The most used and you may effective people to your FHA program are likely as very first-day home buyers who’re obtaining on home control market and want a foot through to the fresh challenging down-fee specifications. They might possess discounts, however it is shortage of to fulfill a consistent surface in the online game specifications from private lenders. While doing so, individuals who don’t possess a credit history otherwise slide with the lower income group realize a huge assistance from the newest system as well. One another might be entirely shut out of one’s housing market toward the private top.

What are the Standards?

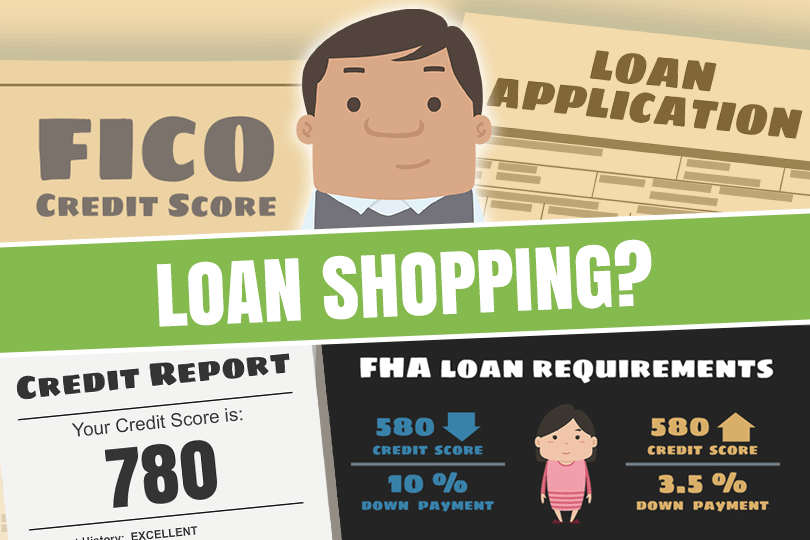

The application demands an excellent step 3.5 percent advance payment for people scoring more 580 within the a beneficial credit rating, or 10% out of men and women a lot more than 500 however, lower than 580. The brand new appraisal of the property could be performed from the a keen FHA appraiser, not an exclusive choices. Financial insurance rates has to be paid down. The brand new borrower needs a constant income source and you may evidence of a position for at least couple of years of the exact same employer, getting over 18 yrs . old, and certainly will use the domestic since the a primary quarters. Consumers should also have the ability to deal with a good 0.85 fee of the mortgage value, energized monthly, which will pay for the expenses of the FHA Financing program. *

Which are the Charges?

There’s an excellent 0.85 % financing worth percentage to possess mortgage insurance rates, charged with the borrowed funds commission. Additionally there is an exclusive mortgage insurance policies payment fees, and additionally combined in the mortgage, for example.75 %. *